Transforming Asia-Pacific Support: How JGS Bridges the Language and Time Zone Gap

North American businesses are racing to expand into booming Asian markets. Asia-Pacific (APAC) is home to 60% of the world’s population and roughly 46% of global GDP1, representing an immense growth opportunity.

But expanding eastward comes with a daunting operational challenge: delivering great customer and technical support in the customer’s language, during their business day. If your support model remains U.S.-centric, you’re asking customers in Japan, Korea, China, Southeast Asia and beyond to accept service that’s out-of-sync and out-of-touch.

The result? Frustrated users, missed SLAs, and lost business in the very markets you worked so hard to win.

Beyond the headline opportunity, the spend pool is already there:

-

The outsourced customer care market is ~$70.2B (2023), on track to ~$89.0B by 2028.

-

APAC contact‑center outsourcing is ~$24.2B in 2024 and growing ~10% annually.

-

Language services add another $61–$72B: clear evidence that budgets already exist to fund in‑language, in‑timezone support when it demonstrably moves the needle.2, 3, 4

Consider the reality: most of your team works 9-to-5 Pacific Time, speaks only English, and goes home just as your Asian customers start their workday. Those customers expect near-instant help in Japanese, Korean, Mandarin, etc., not an overnight email in English.

Research shows 75% of global consumers are more likely to purchase again if customer care is in their native language5. In markets like Japan, over 70% of customers won’t tolerate waiting more than 24 hours for a response (nearly half expect an answer within one hour!)6.

Failing to meet these expectations isn’t just a minor service issue. It’s a deal-breaker. Over half of consumers will stop doing business with a brand after just one negative support experience7. In short, if you can’t provide in-language, in-timezone support, your hard-won Asian customers won’t be your customers for long.

The conventional approaches are falling short. Many U.S. companies default to one of three flawed models to cover Asian support, each with severe limitations:

-

forcing U.S. staff onto graveyard shifts,

-

outsourcing to third-party call centers, or

-

attempting to build full in-country teams.

Each of these tactics seems logical at first… and each can backfire disastrously.

Night-shift crews suffer from fatigue and attrition, outsourcing vendors struggle with quality and integration, and in-region teams are expensive and hard to scale across multiple countries. The immediate symptoms may differ (late responses, language errors, high turnover, etc.), but they all feed the same larger failure pattern, undermining customer experience (CX) and dragging down your growth in Asia.

This article takes a hard look at why these traditional solutions aren’t delivering, and how a fundamentally different approach can break the cycle:

-

Sharply Identifying the Problem: Why serving Asian customers with U.S.-centered teams or legacy vendors creates a systemic CX failure.

-

Exposing the Limitations of Current Models: We examine the hidden costs and pitfalls of U.S. night shifts, conventional BPO outsourcing, and DIY in-region support teams… and how each contributes to a vicious cycle of declining service quality.

-

A Vicious Cycle Unveiled: We map out the self-reinforcing loop of cost-cutting, burnout, inexperience, and poor service that traps companies using these approaches.

-

Introducing the JGS Model: A deliberately inverted solution that replaces night shifts with daytime “follow-the-sun” coverage and swaps low-engagement vendor staff for embedded, bilingual Indonesian professionals working in your systems and culture.

-

Why It Works: We break down the structural reasons the JGS model succeeds: from better language and cultural fluency, to alignment with customer expectations, lower costs, and tighter integration with your U.S. team.

-

A Virtuous Cycle: Finally, we illustrate how this model produces a positive feedback loop of engaged employees, proactive service, delighted customers, and business growth, transforming support from a cost center into a competitive advantage.

If you’ve struggled to provide world-class support to your APAC customers, read on: it’s not for lack of effort, but likely the result of a broken model.

It’s time to rethink the problem from the ground up!

Benchmark: The Gold Standard of Local Support

What does great customer support look like in Asia?

In an ideal world, you’d staff each country with knowledgeable, native-speaking support engineers available during local business hours. A customer in Tokyo would talk to a Japanese rep at 2:00 p.m. Tokyo time, and a client in Seoul would get help in Korean – no language barrier, no graveyard shift delays.

Culturally fluent, in-timezone, in-language service is the gold standard for customer experience. It’s how you win hearts and minds in these markets.

This ideal comes at a tremendous cost.

Hiring full in-country teams means replicating your support operation in every market: a luxury only the largest enterprises can afford.

For example, a skilled bilingual support representative in Japan commands a total compensation around ¥10 million per year (roughly $65k USD fully loaded)8. Benefits, taxes, and overhead add 25–40% on top of base pay9, so one mid-level support engineer in Tokyo can easily cost $80k–90k annually.

And that’s per head. This doesn’t include the substantial startup costs of establishing a local presence. Setting up even a small branch office in Japan can run into the tens of thousands of dollars in legal, administrative, and facility expenses10 before you’ve hired a single employee.

Multiply those expenses across multiple countries—Japan, China, Korea, Indonesia, etc.—and the “ideal” of fully local teams quickly becomes financially untenable for most U.S. companies.

So while local native support may be the CX gold standard, it comes with gold-plated costs and complexity. Most firms are forced to compromise, choosing one of the following “good enough” approaches to support APAC customers:

-

U.S. Night Shift – Flip your domestic team to cover Asian hours, working overnight to respond to APAC customers.

-

Traditional Outsourcing (BPO) – Contract with a third-party call center vendor in Asia to handle support tickets and calls.

-

In-Region DIY Teams – Build your own support offices in key countries, hiring local staff to cover their time zones.

U.S. Night Shift: Fighting Time & Biology

The first instinct is often to cover Asian hours by putting some of your U.S.-based staff on a night shift.

Your domestic team knows the product better than anybody… even though they (mostly) just speak English. So if they flip their schedules, in theory they can handle customer issues coming from the other side of the world. As long as those customers speak English.

This approach seems straightforward… but it runs headlong into human biology and practical language limits.

Forcing your American team to work overnight means asking them to battle their own bodies. Working at 3am local time, week after week, exacts a steep toll. Studies show that night-shift workers suffer a 7.7% drop in productivity due to fatigue and circadian misalignment11. Complex problem-solving, attention to detail, and response times all degrade when your team is fighting their natural sleep rhythm. Worse, the graveyard grind isn’t sustainable: the stress of upside-down schedules roughly doubles the attrition rate of employees12.

In plain terms, you’ll burn out your best people. Every departure kicks off an expensive cycle of recruiting and training a replacement… often costing 50–125% of the employee’s salary in direct and indirect costs12.

It’s a never-ending game of midnight Whack-A-Mole as you scramble to keep the night shift staffed.

And then there’s the language problem.

Even if a few heroic team members endure the night shift, can they actually support your Japanese or Korean customers? Unless you somehow have U.S. staff fluent in Mandarin, Japanese, Korean, etc., your night team is still providing English-only support… which many Asian customers simply won’t use.

Expecting your APAC clients to work through language barriers or wait for a translator is a recipe for frustration. In practice, a U.S. night shift often delivers neither the responsiveness nor the linguistic accessibility that customers demand.

You pay the price in employee well-being and turnover, yet customers still get subpar service. It’s the worst of both worlds.

Traditional Outsourcing: The BPO Vendor Gap

The second common solution is outsourcing customer support to a Business Process Outsourcer (BPO) or call center vendor, often in Asia.

On paper, this seems ideal: vendors in places like the Philippines or India offer 24/7 call centers with multilingual agents at a fraction of U.S. labor costs. You sign a contract, hand off your support calls, and you’re done… right?

Unfortunately, the reality is far messier. Traditional outsourcing introduces a fundamental disconnect between your company and the people serving your customers.

First, consider who staffs your support team when you partner with a BPO vendor.

The outsourcing industry runs on razor-thin margins, so BPO firms hire relatively low-cost (often junior) agents and maximize volume. That leads to chronic turnover and inexperience. Annual attrition rates of 30–45% are typical in call centers9… meaning a revolving door of reps with shallow product knowledge.

In some offshore hubs, attrition can spike even higher (30–50% in parts of the IT/BPO sector13), virtually guaranteeing that the person helping your customer is green and unfamiliar with your product nuances. High churn keeps teams in perpetual training mode, and quality suffers accordingly.

Even when you get capable individuals, the structural model of outsourcing hobbles their effectiveness.

The vendor sells you an external team, working in their siloed systems, following their processes, often oceans away from your core engineering or success teams. This separation creates an “arms-length” support experience.

Vendor agents often rely on rigid scripts and limited knowledge bases. They’re transactionally closing tickets, not deeply engaging with your product or customers. If an issue requires cross-team collaboration or product insight, the outsourced model breaks down.

Every hand-off (from customer to BPO, BPO to your Tier-2/internal team, etc.) is a delay where context and accountability are lost. Even mainstream operators caution that poorly structured outsourcing erodes brand alignment and CX14.

There are also hidden costs that erode the apparent savings of outsourcing.

To coordinate an external vendor team, companies typically incur a Management Overhead Tax: extra project managers and liaisons to bridge between the vendor and your in-house staff. Industry analyses peg this overhead at around 15–20% added cost13: an inefficiency tax that doesn’t exist with a fully internal team.

Despite having those extra managers—if not because of them—communication gaps and rework are inevitable. Time zone differences, cultural nuances, and lack of product intimacy create friction that can sap an estimated 10% of your team’s productivity13. In short, that “cheap” outsourced team often isn’t so cheap once you account for oversight and lower first-contact resolution rates.

Most critically, outsourcing puts your customer experience and brand reputation in someone else’s hands! If the vendor’s quality slips, your customers feel the pain, and your brand takes the hit.

The vendor’s incentives aren’t always aligned with yours. They are paid on volume and SLAs, not long-term customer loyalty.

You also risk losing institutional knowledge because support insights (and even documentation) often stay with the vendor. If you ever terminate the contract, you walk away empty-handed: no trained team, no internal knowledge base, nothing learned. The vendor is a black box, and a bad business decision on their end can easily reveal you to have been dangerously dependent on an external party.

As one analysis put it, when you outsource in the traditional way, you often fail to build any “organizational muscle” around support internally15. You’ve rented a team, but haven’t developed your own enduring capability or culture of customer care.

In-Region DIY Teams: High Investment, Slow and Siloed

The third approach is the big-budget option: establish your own support offices on the ground in Asia.

Instead of outsourcing, you hire employees in Tokyo, Seoul, Singapore, etc., effectively cloning your support org in each locale. This can eventually deliver excellent localized support… but it’s extremely costly and complex to pull off, as we highlighted in the benchmark.

Each country operation requires significant upfront investment (often $50k–$100k+ just to open a small office and comply with local regulations10) and ongoing overhead for management, HR, and facilities. And hiring in Asia’s developed markets is not cheap! You’re competing with local employers and multinationals for a limited pool of bilingual technical talent. Salary expectations in Japan, Korea, and Singapore are on par with (or higher than) U.S. levels for skilled support roles8.

For many mid-sized companies, the DIY approach simply doesn’t scale. Maybe you can afford to build a 5-person support team in one country, but can you do it in five countries? Ten?

The complexity of running multiple distributed teams—each in a different time zone, legal regime, and culture—becomes a management nightmare. You end up with fragmentation: siloed national teams that struggle to stay aligned with HQ and with each other. Best practices and knowledge aren’t easily shared across geographies. Tools and processes diverge. Rather than one integrated global support organization, you’re managing a patchwork of mini support teams around the world.

There’s also a speed penalty.

Launching an in-country team doesn’t happen overnight. Recruiting, onboarding, and training talent in a new region takes months (if not years) to reach full productivity. If you need to spin up support rapidly for a new market or product, a ground-up local hire approach will be too slow to keep up with business. In the interim, your existing customers in that region are left with either no local support or forced back to one of the suboptimal options above.

Finally, as with outsourcing, separate in-region teams can introduce consistency issues.

Without deliberate, difficult effort on the part of your organization, a customer in Korea might get a completely different support experience than one in China or the U.S. Different offices may develop different cultures and standards.

Maintaining a unified quality of service and a unified feedback loop to your product team is hard when support is so distributed. You risk recreating the very silos and gaps that you fired your BPO to eliminate: the right hand (Asia team) doesn’t seamlessly know what the left hand (U.S. team) is doing, and vice versa.

In summary, building your own local support teams is often theoretically ideal for customer service but prohibitively expensive and operationally difficult in practice. It’s a long-term play that many companies cannot execute in time to meet customer expectations today.

So they settle for either the night shift or outsourcing stopgaps… and get caught in a dangerous loop of poor results despite mounting costs.

Racing to the Bottom: A Vicious Cycle

All three of these traditional approaches—the U.S. night shift, the outsourced vendor, and the scattered in-country teams—are attempts to solve the same core problem: how do we support customers around the clock, in multiple languages, without breaking the bank?

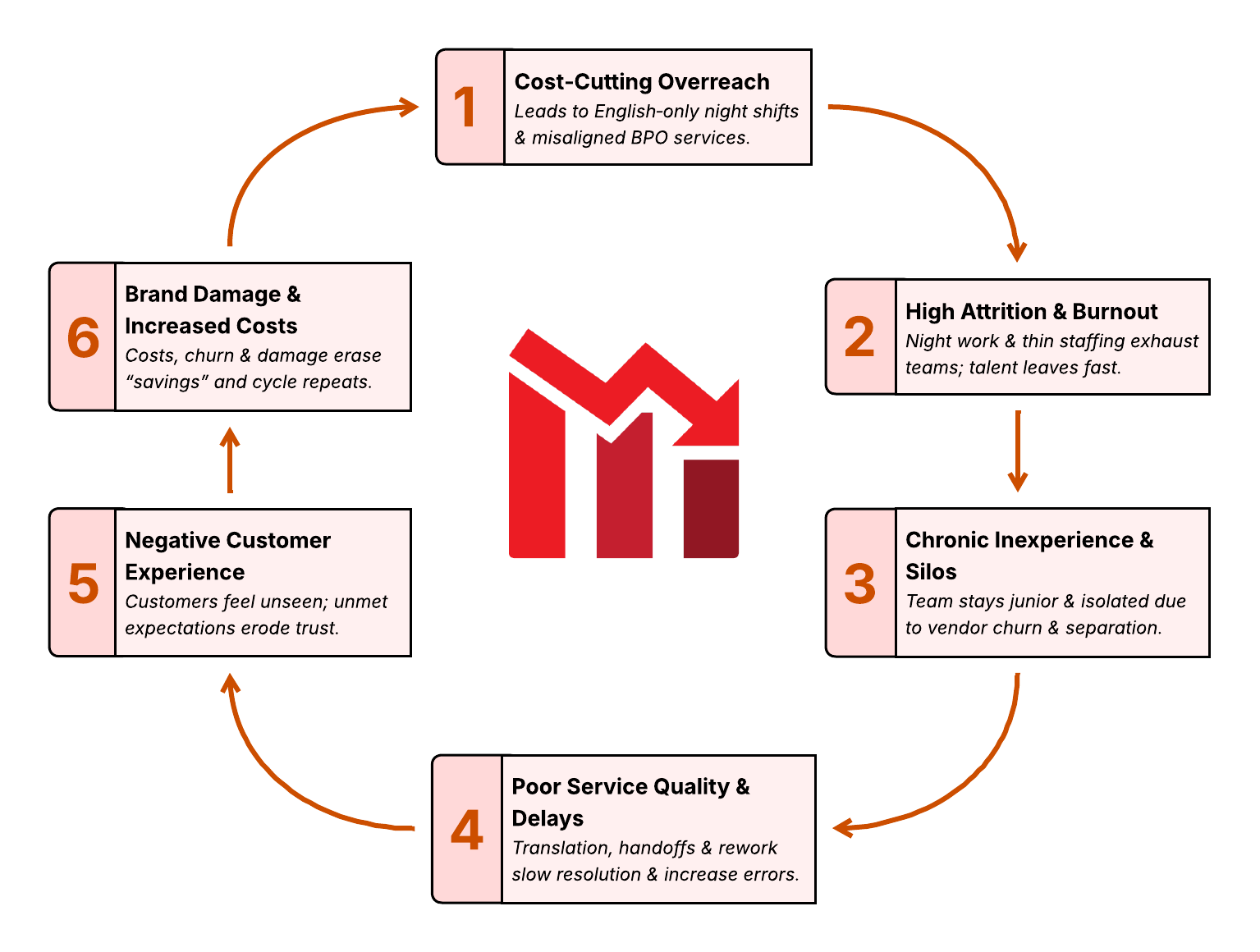

Each tactic fails in its own way, but they ultimately feed into one shared outcome: a self-reinforcing cycle of declining service quality and rising costs. When you try to patch the language/timezone gap with the wrong model, you trigger dynamics that actively undermine your goals. It becomes a vicious cycle:

-

Cost-Cutting Overreach – Pressure to minimize support costs leads to under-resourced teams: e.g. low-paid night shift staff or bargain BPO contracts. The approach is chosen for its cheapness, not effectiveness.

-

High Attrition & Burnout – Overworked, graveyard-shift employees and high-churn vendor agents alike become disengaged and exhausted. Talented team members quit, seeking saner hours or better pay.

-

Chronic Inexperience & Silos – Constant turnover and reliance on junior workers mean the support team is perpetually green. Knowledge isn’t retained or shared. Separate offshore or regional teams operate in isolation, never developing your institutional expertise.

-

Poor Service Quality & Delays – Fatigued or novice staff inevitably make mistakes and solve issues slower. Language barriers and lack of product depth lead to escalations and “I’ll get back to you” responses. Customers encounter long wait times, miscommunications, and unresolved problems7.

-

Negative Customer Experience – Frustrated by inconsistent, slow, or ineffective support, customers lose trust. Loyalty erodes; some customers churn after just one bad interaction7. Others become less engaged, reducing upsell or referral opportunities. Your brand reputation in the region suffers.

-

Escalating Costs & Damage – Here’s the irony: the very measures taken to save money end up increasing costs. You spend more on recruiting/training due to attrition, more on appeasing unhappy customers, and more on firefighting quality issues. Meanwhile, a tarnished brand makes it harder to attract new customers (and top talent). Under pressure, management often responds by cutting costs further—slashing vendor rates or overloading the night team—which only perpetuates the cycle.

This race to the bottom doesn’t happen because you or your team don’t care or aren’t working hard. It’s structural.

When the primary strategy is to “make do” with a misaligned model (whether by squeezing labor costs or fragmenting the org), the outcome is almost predestined. Biology, economics, and human nature assert themselves. No amount of individual heroics can consistently overcome systemic fatigue, communication gaps, and lack of ownership.

In the end, you’re left with a support function that is more expensive than it appears on paper and far less effective than you promised your customers.

To break this cycle for good, a fundamentally different approach is needed: one that inverts the model rather than trying to brute-force it.

That’s where John Galt Services comes in.

John Galt Services: The Smart Alternative

Imagine you could give your Asian customers all the benefits of the gold-standard local support—native language, real-time help during their workday, culturally savvy service—without the usual trade-offs of cost and fragmentation.

John Galt Services (JGS) was built to deliver exactly that. We’ve rearchitected the global support model from the ground up to align incentives, time zones, and talent in a way that breaks the vicious cycle you’ve been caught in.

The core JGS insight is simple but profound: The root cause of the failure is the night shift itself.

Instead of contorting your operations to cover Asia from the U.S., we flip the model. JGS employs full-time, elite professionals based on Bali, Indonesia: a strategic location that is in the heart of the APAC time zone (GMT+8) and only a few hours behind Tokyo/Seoul.

When it’s midnight in New York, it’s high noon on Bali.

By following the sun, our team works during their normal daylight hours, providing support to your Asian customers during their local business day. There’s no graveyard fatigue because, for JGS staff, it’s not a graveyard shift at all. We eliminate the problem of fighting biology. Fatigue is eradicated by design!11 This Asia‑day advantage is the operational wedge that enables follow‑the‑sun coverage without asking anyone to work nights16.

Time zone alignment is just the beginning. The JGS model goes much deeper by tackling the economic and organizational misalignments that plague outsourcing and remote teams.

We don’t rent you a low-cost offshore squad and leave you with the same integration headaches. Instead, we become an extension of your in-house team. Our professionals work within your systems, on your hours, under your direction… just located on Bali, not Boston.

It’s your team, your terms, your tools, your rules: your culture. We deliberately forgo the typical outsourcing volume game in favor of a quality-over-quantity philosophy.

In fact, we’ve turned the traditional vendor model upside-down in several key ways:

-

Attracting Elite Talent – We hire only the top 0.1% of multilingual professionals in Indonesia, paying well above local market rates to attract and retain career-minded experts. This solves the twin problems of talent quality and attrition.

-

Your Outcome ≫ Our Margin – We operate on thin margins and reinvest heavily in our people and processes to ensure superior performance. Our incentives are aligned with yours: we win when you win.

-

Organizational Muscle ≫ Vendor Dependency – Our team members are embedded in your workflows and systems, ensuring that knowledge and processes stay with you. We help you grow your internal capabilities rather than creating external dependencies.

-

Customer Champions ≫ Support Agents – We cultivate empowered, proactive professionals who take ownership of the customer experience and act as true brand ambassadors. This transforms support from a cost center into a competitive differentiator.

-

Transparent, All-Inclusive Pricing – We offer simple, flat-rate pricing that undercuts typical U.S. staffing costs by a wide margin. There are no hidden fees or surcharges—just one predictable cost for a high-caliber resource.

Attracting Elite Talent

JGS solves the talent quality issue at the source: we hire top-tier professionals and make it irresistibly attractive for them to build a long-term career with us.

Our hiring pool is the nation of Indonesia: one of Asia’s largest, youngest, and most-educated talent markets. We’re located on the island of Bali: a tech and lifestyle hub that draws ambitious professionals from across the region.

We seek out candidates who are perfectly fluent in English and at least one other Asian language. Our team collectively covers English, Mandarin, Japanese, Korean, Indonesian, Malay, Thai, Tagalog, Vietnamese, Arabic, and more17.

Indonesia has one of the world’s largest communities of Japanese learners (second only to China), strengthening the pipeline for JP‑language roles18.

These are not entry-level call center agents! They are experienced support engineers, customer success specialists, and technologists with the multilingual skills and cultural IQ to serve your diverse customer base.

How do we attract the best of the best in these markets? Fair question: We pay far above local market rates! Typically, JGS pays 2–3× the local norm for a given role.

JGS offers Silicon Valley-grade compensation by Southeast Asian standards, plus a modern work environment and continuous growth opportunities.

This is unheard-of in traditional offshoring.

That premium investment in people yields a huge advantage: it creates a flood of applicants and lets us be extremely selective. We evaluate 1,000+ candidates for every hire, rigorously filtering for technical ability, language fluency, and a proactive, detail-oriented mindset. Only about the top 0.1% ever make the cut to be presented to you for an interview.

The result is that every JGS team member is an elite talent: the kind of highly motivated, skilled professional you might struggle to recruit at home, but who is excited to join JGS on Bali for a fraction of the cost of a U.S. hire.

By paying well and treating support as a craft, we also solve the attrition problem. JGS roles are coveted, career-track positions: NOT transient gigs. Our attrition rate is virtually zero.

Year over year, the same experts stay on your account, deepening their product knowledge and customer rapport. Contrast this with a typical vendor call center where seats turn over every few months. With JGS, you get continuity and accumulating expertise on your product and customers that only grows stronger with time.

Trading Margin for Outcomes

“Wait a second,” you might ask. “How can JGS afford to hire such great people and charge less than what I’d pay my own team?”

Fair question. The answer lies in a conscious strategic choice: we trade OUR margins for YOUR outcomes.

Traditional outsourcing vendors make money on the spread: they hire cheap and charge you more, pocketing the difference. We reject that old model. JGS operates on unusually thin margins for a service business. We’re not aiming to maximize profit per head; we aim to maximize the value each head delivers to you.

In practice, this means we reinvest a big portion of our revenue into our people and our process to ensure superior performance.

The budget a typical vendor would earmark as profit or spend on layers of bureaucracy, we redirect to things like: higher salaries, continuous training, better collaboration tools, and robust integration with your team.

We don’t nickel-and-dime on quality. If your JGS engineers need a certification course or a new piece of equipment to do their job better, it’s handled at no extra cost to you. Their mission is your mission.

Our business philosophy is that if we deliver tangible, outstanding outcomes (faster resolutions, higher CSAT/NPS, lower backlog, etc.), then we will grow as you grow. We’re playing the long game: delighted clients stay with us for years and expand their engagements, which is far more valuable than squeezing you for short-term margin. In essence, our incentives are aligned with yours. We win when you win: when your customers are happy and your support operation runs like a well-oiled machine.

Build Organizational Muscle, Not Vendor Dependency

A key difference in the JGS model is our engagement philosophy: Your Team, Your Terms, Your Tools, Your Rules.

Our goal is not to be an opaque third-party service provider; it’s to become an integrated extension of your own organization. Practically, this means our team members work inside your environment. They participate in your daily stand-ups. They use your support ticketing system, your knowledge bases, your collaboration platforms… whatever you use, that’s where your Bali team operates.

To your end customers, they will feel like any other employee of your company (just one who happens to respond at 10am Singapore time).

Why do we insist on this level of integration? Because it ensures that the knowledge and processes stay with you.

Unlike a traditional outsource arrangement, where vital know-how lives and dies within the vendor’s walls, a JGS-augmented team continuously feeds expertise back into your organization. All the tickets resolved, documentation created, and playbooks refined by the JGS professionals become part of your internal assets (we often help improve and localize documentation as a value-add).

If one of our team members eventually moves on, your support operation remains intact. You haven’t lost a step, because everything they worked on is in your systems and your institutional memory. This is how you build muscle instead of dependency. Over time, you are stronger as an organization for having worked with us, not weaker15.

Contrast this with outsourcing as usual, where you might wake up to find your vendor has rotated out the entire team or lost a key engineer, and you’re back to square one. Or worse, the vendor itself might go under or be acquired… and suddenly you have no one answering your customers, and no internal team ready to step in.

JGS mitigates that risk entirely. Your JGS teammates are embedded in your workflows and trained on your products, just like your in-house staff. If needed, you could absorb some of them later on. In fact many of our clients end up hiring a JGS superstar full-time. We view that as a success, not a failure! The point is, we are enabling you to grow your own capabilities in a flexible way, rather than making you dependent on an external black box.

Furthermore, because JGS hires top talent and treats them as such, our professionals are not just ticket-takers: they often become trusted agents of change within your support org. They bring fresh perspectives from their diverse experience and can help uplevel processes, share best practices from other environments, and even train or mentor junior in-house staff.

We’ve seen JGS team members evolve into de facto team leads, documentation champions, or process improvers for our clients. Again, all of that goodness stays inside your company. You effectively get a world-class global support team while growing your internal knowledge base and standards.

From Support Agents to Customer Champions

Perhaps the most important element is the mindset and empowerment of the people we provide.

In the legacy models, offshore support workers are often treated as cogs in a machine. They’re given narrow scripts, measured solely on handle times, and kept at arm’s length. It’s no wonder they become disengaged “pass-through” agents.

JGS takes the opposite approach: we cultivate customer champions who are encouraged to take ownership of the customer experience and go the extra mile. Our team members know that they are your brand ambassadors in front of your APAC customers, and they embrace that responsibility with pride.

We hire people who are innately proactive problem-solvers, and then reinforce that behavior with training and incentives.

JGS professionals are empowered to think beyond the script. If they notice that certain queries are recurring, they won’t just resolve them repeatedly: they’ll raise the issue with your product or support leadership and suggest improvements (e.g. a FAQ entry, a UI tweak, or a new troubleshooting workflow) to eliminate the root cause.

If a high-value customer has a unique concern, our folks act as true advocates: coordinating with your team in the U.S. to get it addressed, rather than saying “not my problem, please talk to HQ.” In other words, they function like real team members, not contracted temps.

This empowerment translates directly into better service.

Customers get faster, more thoughtful responses because the person on the other end is experienced, alert (it’s daytime for them!), and genuinely invested in solving the issue. Language fluency and cultural awareness mean they can empathize and communicate effectively… building rapport with, say, a Japanese customer in a manner that respects Japanese norms, which is very different from an American casual tone.

By providing support in the customer’s own language and style, we increase customer comfort and trust. This kind of experience creates loyalty. It turns support from a pain point into a competitive differentiator.

There’s a feedback loop here too: when support agents are empowered and skilled, their jobs are more fulfilling. They can see the positive impact of their work on customers and on the product.

This boosts morale and retention further: an internal virtuous cycle that complements the external one we’ll describe in a moment.

Numerous studies have shown that engaged, empowered employees deliver higher productivity and innovation, which in turn leads to better customer outcomes and business results7. We’ve engineered those conditions into the JGS model from day one.

Transparent, All-Inclusive Pricing

We’ve already touched on pricing, but it bears repeating because it’s so simple: every JGS full-time resource costs the same flat rate, regardless of role or seniority.

We don’t play games with junior vs. senior agent billing; you get the right person for the job at one price. And that price is all-inclusive. You’re not going to get nickeled-and-dimed for “project management fees” or “seat costs” or any of the other surcharges traditional vendors slip in. One fee, one invoice: everything included (recruiting, training, management, benefits, IT equipment, etc.).

This radical transparency is part of our trading margin for outcomes ethos. We’d rather be straightforward and budget-friendly, and then prove our value through results, than lure you with a teaser rate and surprise you later.

To recap, our current pricing per full-time team member is:

-

$1,920/month with an annual commitment (comes out to just $12/hour),

-

$2,240/month quarterly (about $14/hour), or

-

$2,560/month month-to-month (~$16/hour)19.

Many clients opt for an annual commitment once they see the quality, to lock in the lowest rate. But even the month-to-month rate is dramatically lower than hiring equivalent talent in-house in the U.S. (or in Japan, etc.), and without the overhead of establishing foreign entities.

It’s also significantly cheaper than what most BPO vendors would charge for a dedicated bilingual support agent… and with JGS, you’re getting a higher caliber individual integrated into your team.

We price this way not because our people are “cheap” (remember, we pay them exceptionally well by local standards), but because our operational efficiencies and lean philosophy let us run profitably at these rates.

Bali’s lower cost of living, for example, means we can provide a great office environment and benefits at low expense. And by avoiding unnecessary bureaucracy, we keep overhead down. We pass those savings directly to you.

The bottom line is JGS lets you upgrade your support quality while lowering your support costs. It’s an outcome that was virtually impossible under the old models.

Winning By Design: The JGS Virtuous Cycle

The failure of traditional approaches wasn’t due to lack of effort; it was due to a misalignment of structure and incentives.

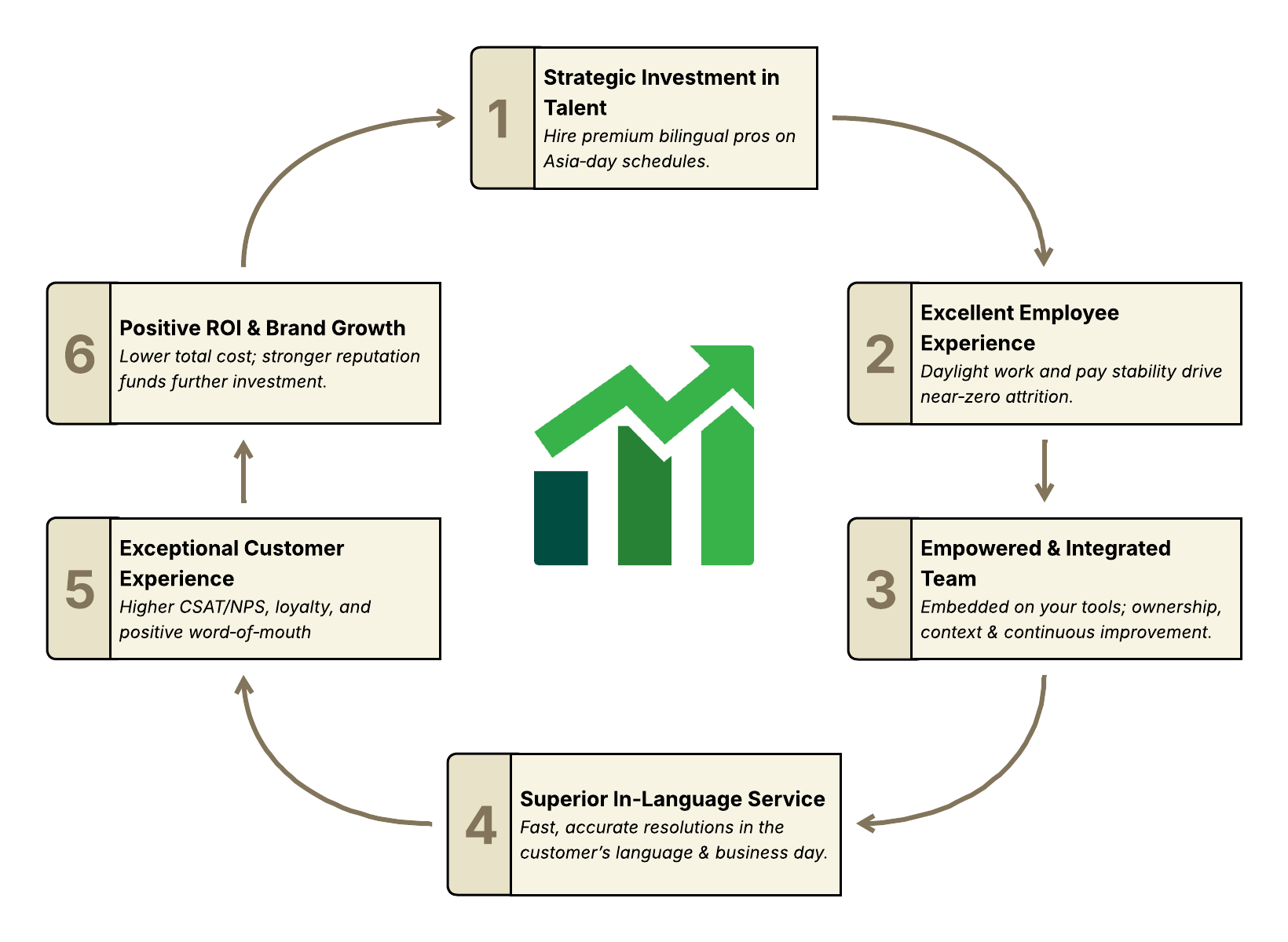

By realigning these through the JGS model—right talent, right time zone, right integration—we intentionally flip the negative dynamics into positive ones. What emerges is not just a one-time improvement, but a self-reinforcing success loop.

Here’s what the on-purpose dynamics of JGS look like in motion:

-

Strategic Investment in Talent – Instead of chasing low labor costs, you invest (via JGS) in premium, multilingual talent who work daylight hours. This attracts top performers and sets them up for success (no burnout).

-

Excellent Employee Experience – Your extended team is engaged, well-rested, and well-compensated. Morale is high, and attrition is near-zero, so expertise accumulates7.

-

Empowered & Innovative Team – A stable, skilled team that feels ownership will continuously improve. They tackle problems proactively, share knowledge freely, and drive ongoing innovations in support processes and product feedback.

-

Superior Service Quality – Customers receive fast, accurate, in-language support from experienced professionals. Issues are resolved on the first contact more often, and preventative fixes start to reduce incoming volume. Customer satisfaction so.

-

Exceptional Customer Experience – Delighted by the quality and personal touch of support, customers become more loyal. They trust your brand because you “get” them: you speak their language (literally and figuratively) and solve their needs. This boosts retention and word-of-mouth growth.

-

Positive ROI & Growth – Higher loyalty and retention translate into increased customer lifetime value and positive ROI on support. A great support reputation becomes a selling point in new sales. Meanwhile, lower turnover and efficient operations keep costs stable. The business case for investing in support is validated, freeing resources to reinvest in further talent and innovation, fueling ongoing success.

This virtuous cycle is the mirror image of the vicious cycle we discussed earlier.

When you have the right model, each part of the system reinforces the others beneficially. Management is no longer stuck in reactive fire-fighting or penny-pinching mode; you can focus on strategic improvements because the fundamentals are solid. Your support function turns into a source of competitive advantage. It builds goodwill and differentiation in markets where perhaps your product alone was not enough to win… but your superior service sets you apart.

Importantly, these outcomes aren’t hypothetical. They’re the patterns we’ve observed with JGS clients who have transformed their support using our Bali-based teams. By aligning time zones, languages, and incentives, you create a support operation that consistently delivers delight to customers.

And happy customers, as we all know, tend to become repeat customers, refer others, and expand their business with you.

The Bottom Line: Customer Support as a Competitive Advantage

Expanding into APAC doesn’t have to mean compromising on customer support.

The old dilemma of fast, good, or cheap – pick two is no longer applicable. With a strategically crafted model like JGS, you can have fast, good, and cost-effective support, simultaneously. That means you can scale confidently in new markets knowing your customer experience will be an asset, not a liability.

Let’s recap the transformation:

-

U.S.-based companies were struggling with late-night shifts, underperforming outsourcers, or costly local hires… each leading to customer frustration and mounting hidden costs.

-

By partnering with JGS, these companies instead get daytime, native-language support delivered by world-class professionals who operate as a seamless extension of the home team.

-

The vicious cycle is broken. In its place stands a virtuous cycle of engaged employees, high-quality service, loyal customers, and growing brand equity in Asia.

In concrete terms, what was once a dreaded cost center—support for “difficult” foreign customers in far-flung time zones—can be turned into a profit center and a growth driver.

When your Asian customers rave about how responsive and understanding your support is, it directly feeds your top line. It’s easier to land new deals when prospects hear about your service reputation. It’s easier to expand existing accounts when users feel genuinely cared for. And internally, your support organization stops draining resources and starts contributing to innovation (through valuable customer insights and process improvements).

None of this is magic.

It’s achieved by smart design: aligning people, process, and technology across borders in a way that traditional thinking did not. By leveraging the talent hub of Bali and an ethos of integration, JGS provides a solution that is at once globally distributed and tightly knit.

It’s an inversion of the standard offshoring script – one where everyone, from your customers to your CFO, comes out ahead.

The time zone is the moat. The multilingual talent is the weapon. The embedded model is the strategy.

In the end, delivering outstanding support to your Japanese, Korean, Chinese, and other APAC customers isn’t just a nice-to-have or a compliance exercise. It’s a strategic imperative if you want to truly succeed in those markets. Companies that recognize this and act boldly—designing their support for excellence through models like JGS—will cultivate the customer trust and loyalty that competitors simply can’t match with half-measures.

Your Asian customers have the same high expectations as your Western ones (if not higher). Exceed those expectations, and they will reward you with their business and their advocacy.

JGS is here to make sure you can deliver, day in and day out, in every language and every time zone you need. The night shift era is over; the follow-the-sun era is here.

Let’s transform your global support operation into a world-class, customer-winning engine… and turn your expansion into Asia from a risky leap into a thriving, sustainable success.

Footnotes

-

Sustainability in Asia Pacific – PwC Global Insights – Notes that Asia-Pacific is home to over 60% of the world’s population and nearly half of global GDP:contentReference[oaicite:0]{index=0}. ↩

-

Outsourced Customer Care Services Global Market Report 2024 – TBRC notes the market at ~$70.2B in 2023, forecast to ~$89.0B by 2028:contentReference[oaicite:5]{index=5}. ↩

-

Asia Pacific Contact Center Outsourcing Market Report 2025 – Cognitive Market Research estimates APAC CCO market at ~$24.2B in 2024 with ~10% CAGR:contentReference[oaicite:6]{index=6}. ↩

-

Language Services Global Market Report 2025 – TBRC projects the language services market to reach ~$61.5B in 2025, on track for ~$88.9B by 2029:contentReference[oaicite:7]{index=7}:contentReference[oaicite:8]{index=8}. ↩

-

Can’t Read, Won’t Buy – B2C (2020) – CSA Research study where 75% of consumers said they’re more likely to purchase again if customer care is in their native language:contentReference[oaicite:1]{index=1}. ↩

-

US vs. Japan – The Key Difference in Customer Support (transcosmos, 2024) – A survey showed 70.5% of Japanese customers won’t tolerate a >24h wait, and ~50% expect a response within one hour:contentReference[oaicite:2]{index=2}. ↩

-

Transforming 24/7 Operations: How JGS Redefines Night Shift Economics – Synthesizes research on churn risk after poor support interactions and the cost differential between acquisition and retention. ↩ ↩2 ↩3 ↩4 ↩5

-

Customer Service Salary in Japan – Levels.fyi – Median total compensation for Customer Service roles is ~¥9.9M (≈$65k USD) in Japan:contentReference[oaicite:4]{index=4}. ↩ ↩2

-

Customer Service Burnout: Why, When, & How to Minimize Agent Turnover – Explains typical call-center attrition rates (30–45%) and drivers of turnover:contentReference[oaicite:3]{index=3}. ↩ ↩2

-

Setting Up Business in Japan: Costs and Procedures – JETRO guidance on initial costs to establish a branch office (often tens of thousands of USD before hiring). ↩ ↩2

-

Transforming 24/7 Operations: How JGS Redefines Night Shift Economics – Shows a ~7.7% productivity deficit on night shifts and how daylight coverage avoids fatigue penalties. ↩ ↩2

-

Transforming 24/7 Operations: How JGS Redefines Night Shift Economics – Discusses elevated attrition on night shifts and replacement costs of 50–125% of salary. ↩ ↩2

-

Transforming 24/7 Operations: How JGS Redefines Night Shift Economics – Details “management overhead” (15–20%) and coordination friction (~10%) when operating separate vendor teams. ↩ ↩2 ↩3

-

Call Center Outsourcing: Pros, Cons & Best Practices – Forbes Advisor – Warns of risks in traditional outsourcing, including compromised brand alignment, knowledge gaps, and loss of control. ↩

-

Transforming 24/7 Operations: How JGS Redefines Night Shift Economics – Argues for building internal “organizational muscle” vs. long-term vendor dependency. ↩ ↩2

-

What’s the Real Outsourcing Cost Savings in Latin America? – Auxis – Highlights “follow‑the‑sun” advantages from near-shore time-zone alignment, yielding ~10–20% productivity gains across regions. ↩

-

John Galt Services – Supported Languages – JGS highlights coverage across English, Mandarin, Japanese, Korean, Indonesian, Malay, Thai, Tagalog, Vietnamese, Arabic, and more. ↩

-

Indonesia Has Largest Number of Japanese Language Learners – Antara News citing the Japan Foundation: Indonesia ranks second (872k learners) only to China (1.05M) in number of Japanese learners. ↩

-

John Galt Services – Pricing – Transparent, all‑inclusive monthly pricing per FTE: $1,920 (annual), $2,240 (quarterly), $2,560 (monthly). ↩